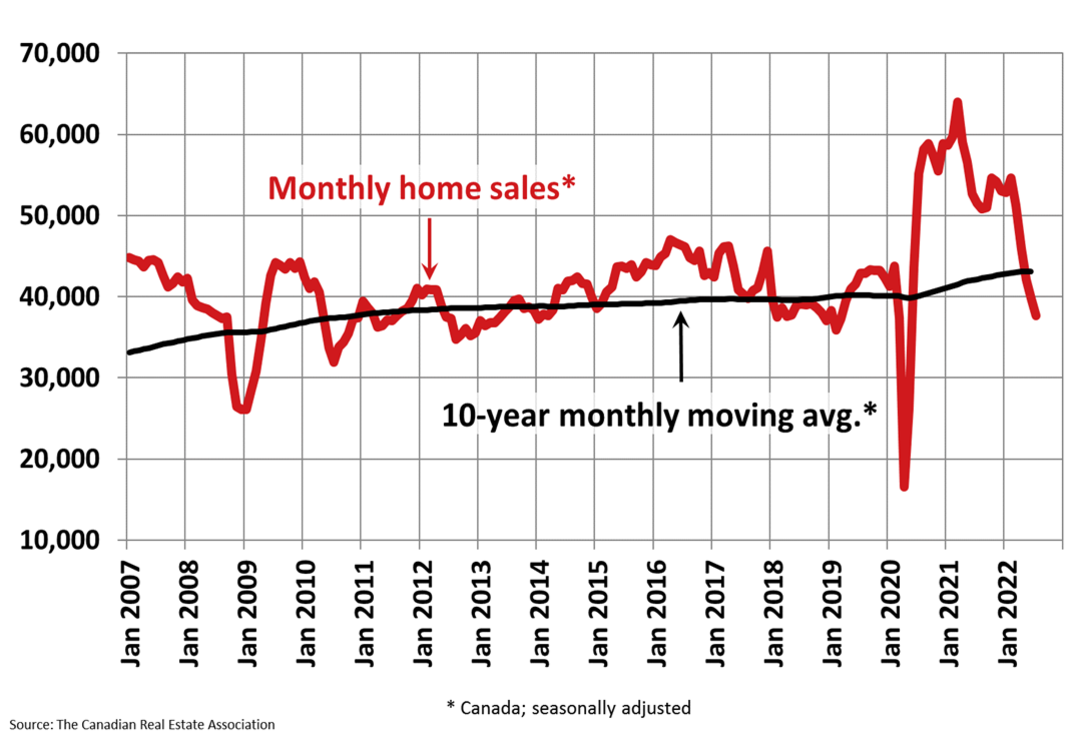

As home sales decrease for the fifth straight month, home buyers and sellers are "playing the waiting game."

Between June

and July, home sales decreased for the fifth straight month, according to the

Canadian Real Estate Association, but this latest decline was the smallest of

the five.

According to

the association, sales in July decreased 5.3% from June on a seasonally

adjusted basis. When compared to July of last year, the actual number of sales

last month was 37,975, a 29% decrease.

"Without

adjustments, July sales were the lowest since the financial crisis in

2020."

The

month-over-month sales decline in July was the smallest of the previous five

months. Market observers stated that it is too early to predict whether this

trend will persist.

Though

bidding battles were the norm last year and early this year, analysts and CREA

chair Jill Oudil said it is a continuation of the market cooling.

The Bank of

Canada raised its benchmark interest rate by one percentage point to 2.5% in

July, the greatest increase the nation has experienced in 24 years, which is

largely responsible for the slowdown.

The impact

on purchasing power is often mirrored by changes in mortgage rates.

Many

purchasers have remained on the sidelines as rates have increased and sales

have declined, believing better offers will emerge in the fall and upsetting

sellers who have to accept the fact that their homes probably won't sell for as

much as neighbours who sold in the winter.

According to

Davelle Morrison, a Toronto broker at Bosley Real Estate Ltd., "There are

definitely a lot more people waiting until September before they offer

properties and they're trying not to list in August, if they can help it."

As a result,

there were 73,436 new listings in total in July, which is 6% fewer than in July

of previous year and, when adjusted for season, 5% fewer than in June.

People might

buy before selling their own house earlier this year when homes were flying off

the market with minimal risk of their property not selling.

Because

properties are remaining vacant for such a lengthy time, Morrison is now

advising clients to sell their residence first.

The national

average price is reduced by $104,000 when the Greater Vancouver and Toronto

Areas are excluded from the calculation.

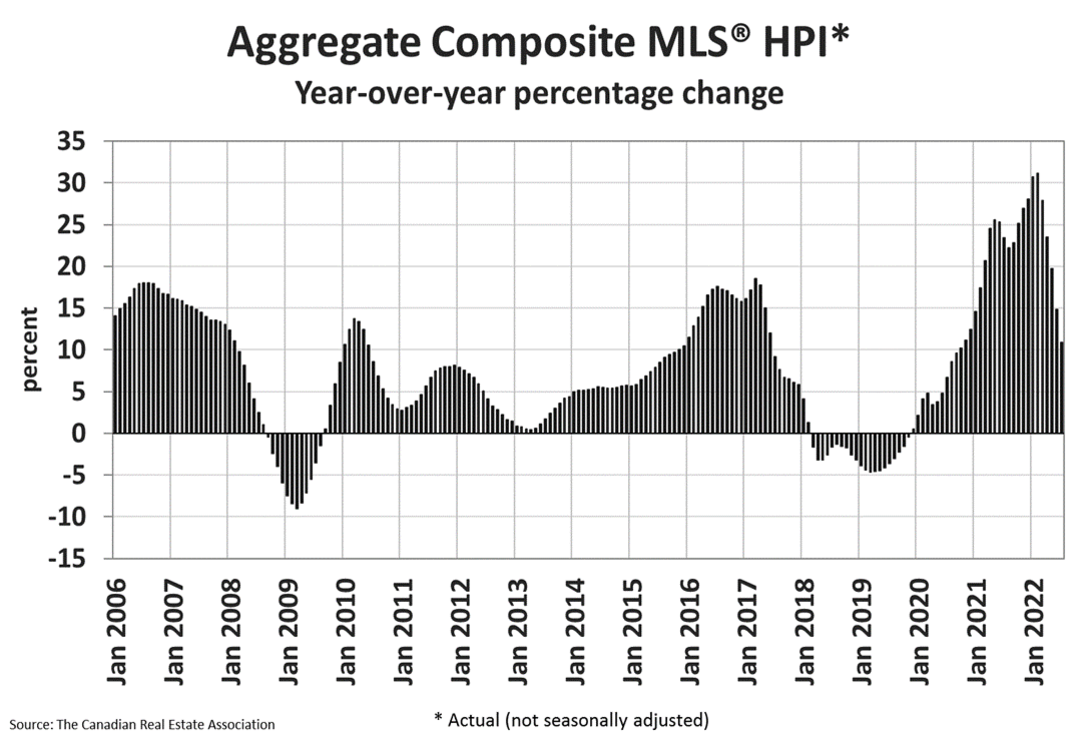

According to

Kavcic, the declines are part of a market correction that is "nearly

everywhere, but to varied degrees" in progress.

With markets

like Kitchener-Waterloo and London down around 15% from their highs, he claimed

that Southwestern Ontario is suffering the most.

He has seen that prices in Montreal have dropped over the past two months but have not been as affected by the downturn as they have been in Vancouver, where decreases have already occurred for four straight months.

This

report by The Canadian Press was first published Aug. 15, 2022.

Source

By: CTVNews.Ca