As 2024 unfolds, Canada’s condominium market is

experiencing a significant surge in inventory, with double-digit increases

reported in most major urban centres. The rise in available listings signals

that sellers, encouraged by the prospect of future interest rate cuts, are

returning to the housing market. Buyers, although cautious, are beginning to

re-engage, testing the waters before further rate reductions materialize.

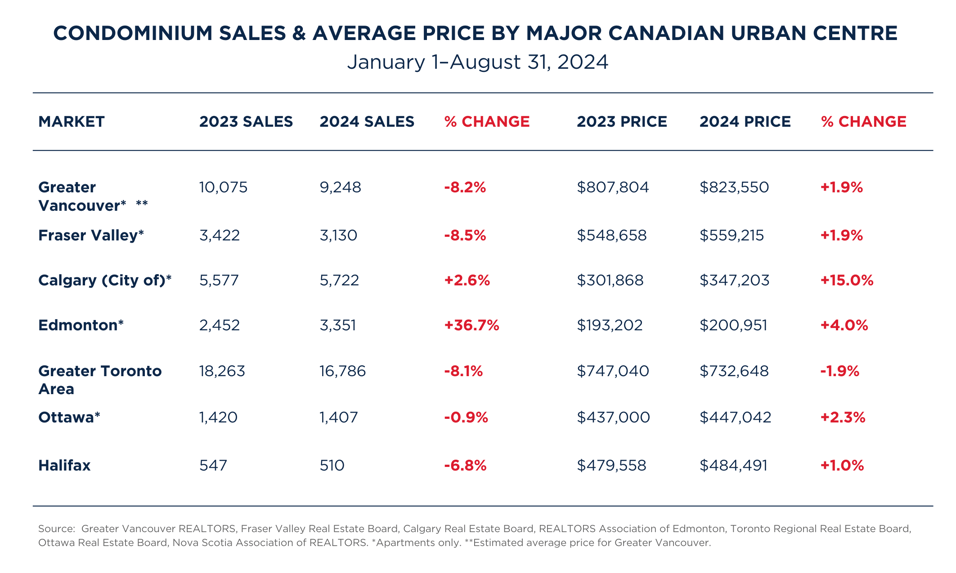

RE/MAX analyzed condominium activity between January

and August 2024 across seven key markets: Greater Vancouver, Fraser Valley,

Calgary, Edmonton, Greater Toronto, Ottawa, and Halifax. The findings show that

condo listings have increased substantially as sellers anticipate higher demand

in late 2024 and early 2025. The highest growth in inventory was recorded in

the Fraser Valley (58.7%), followed by Greater Toronto (52.8%), Calgary

(52.4%), Ottawa (44.5%), Edmonton (17.7%), Halifax (8.1%), and Vancouver (7.3%).

Despite the influx of listings, values have remained resilient, with notable price increases in Calgary (15%), Edmonton (4%), Ottawa (2.3%), Vancouver (1.9%), Fraser Valley (1.9%), and Halifax (1.2%). The only exception was Greater Toronto, where prices dipped by 2%. Sales activity was particularly strong in Alberta, with Edmonton leading the way with a nearly 37% increase in condo sales compared to last year. Calgary saw a more modest 2.6% increase, while other markets experienced a softening in sales activity.

Interest Rates, Buyer Hesitation, and What Lies

Ahead

High interest rates and strict lending policies have

weighed heavily on first-time buyers in recent years, with many unable to

achieve homeownership despite facing soaring rental costs. However, RE/MAX

Canada President Christopher Alexander suggests this current lull may be

temporary. "This is the calm before the storm," he says. Pent-up

demand is expected to drive stronger market activity in spring 2025,

particularly at entry-level price points, as first-time buyers and investors

re-enter the market.

Alberta's condominium markets remain firmly in

seller’s market territory, while conditions in Greater Vancouver, Fraser

Valley, Ottawa, and Halifax have balanced out. These markets are expected to

transition further in 2025. Toronto, however, may take longer to recover from

its sluggish performance. But as Alexander notes, "Toronto is a market

that can turn quickly," with absorption rates serving as a key indicator

for its rebound.

While rising inventory is drawing more interest from potential buyers, many remain cautious, given the recent rate increases. Early interest rate cuts in 2024 did little to spur significant market engagement, but with more cuts and policy adjustments expected, activity is likely to pick up—especially among end users.

Hot Pockets and Emerging Trends

Even in softer markets, certain condo pockets are

defying the overall trend. In Greater Toronto, midtown communities such as

Yonge-Eglinton and Forest Hill South saw double-digit sales increases in early

2024. The west end's High Park and Roncesvalles neighborhoods also posted

strong gains, as did the Beaches in the east end. In Greater Vancouver,

suburban areas like Port Coquitlam and recreational hubs such as

Whistler/Pemberton reported increased sales.

Investor activity, however, has slowed, particularly

in Greater Toronto, where up to 30% of investors are experiencing negative cash

flow due to rising mortgage costs. Despite high rental demand and low vacancy

rates, investor confidence is expected to recover as interest rates fall and

returns on investment improve. Edmonton stands out as an exception, where

investors have been actively revitalizing older condo properties, benefiting

from the city's affordability and lower development costs.

A Window of Opportunity for Buyers

"This is a unique moment for aspiring condo

buyers," says Alexander. End users are now in the driver's seat, with less

competition from investors and a better supply of available units, especially

in markets like Toronto and Vancouver. As values are expected to rise, buyers

could be entering the most favorable climate in years.

Immigration and Long-Term Demand

Looking ahead, immigration will continue to bolster

demand for condominiums, as newcomers to Canada increasingly view condos as

both a first and middle step toward homeownership. While population growth may

slow in the short term, projections by Statistics Canada estimate the

population will reach up to 49 million by 2035, supporting long-term demand for

condominiums.

Urbanization and increasing density will further fuel

the condo market's growth, with condos becoming the heart of Canada's largest

cities. As urban cores evolve, younger generations are driving demand for

vibrant communities with robust amenities, ensuring that condominiums remain

central to the housing mix.

"The evolution of Canada’s housing market is well

underway," says Alexander. "Condominiums are not only adapting to

this new reality but are poised to become the driving force of urban real

estate for years to come."